Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Descrição

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

Overview of FICA Tax- Medicare & Social Security

Social Security Administration - “What is FICA on my paycheck

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Self-employed and FICA Taxes - OSYB Number Crunch! Bookkeeping

Credit for Employer Social Security and

What are FICA Taxes? 2022-2023 Rates and Instructions

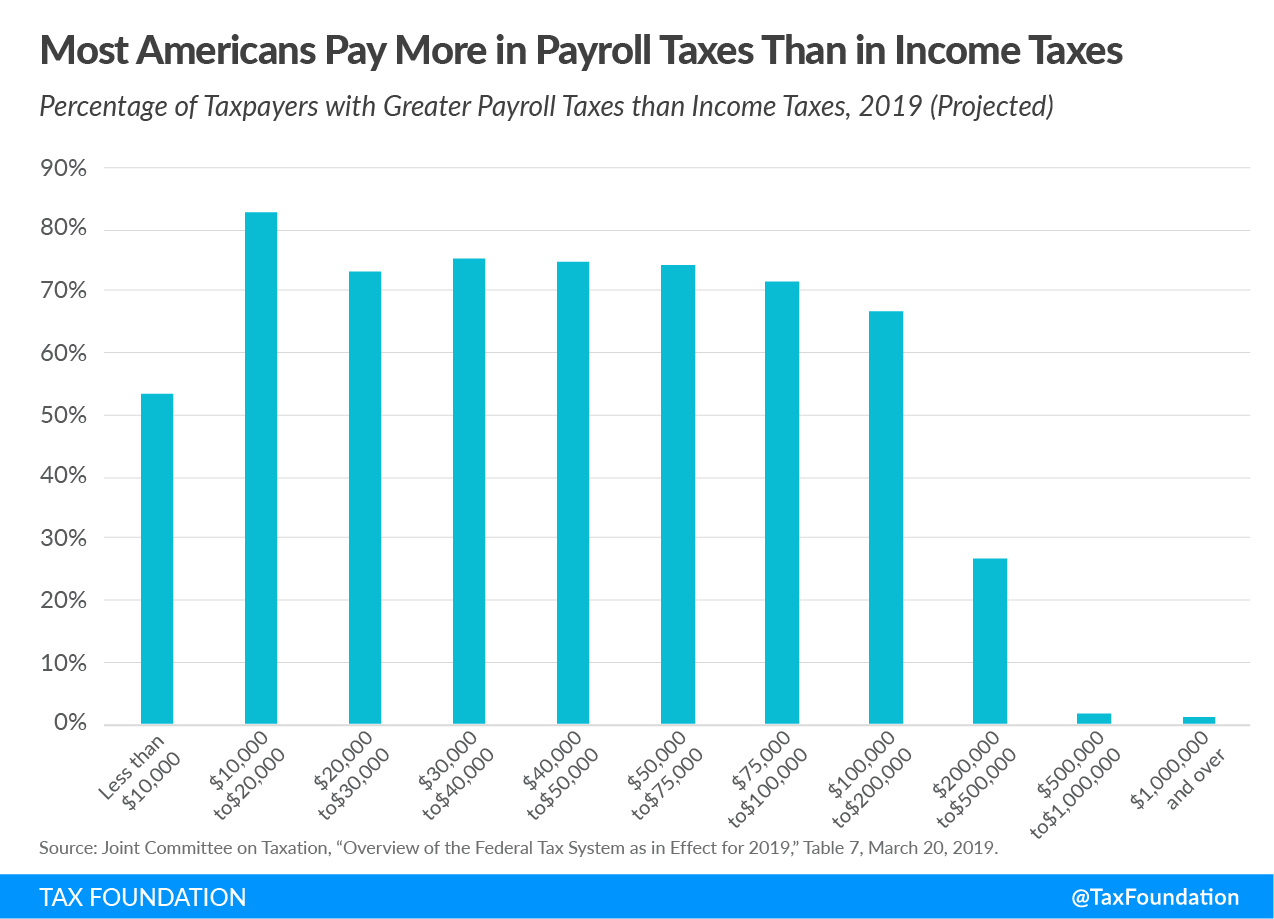

Payroll Taxes: What Are They and What Do They Fund?

What is Payroll Tax? Definition, Calculation, Who Pays It

Fixing Social Security and Medicare: Where the Parties Stand - The

Payroll Tax Definition, What are Payroll Taxes?, TaxEDU

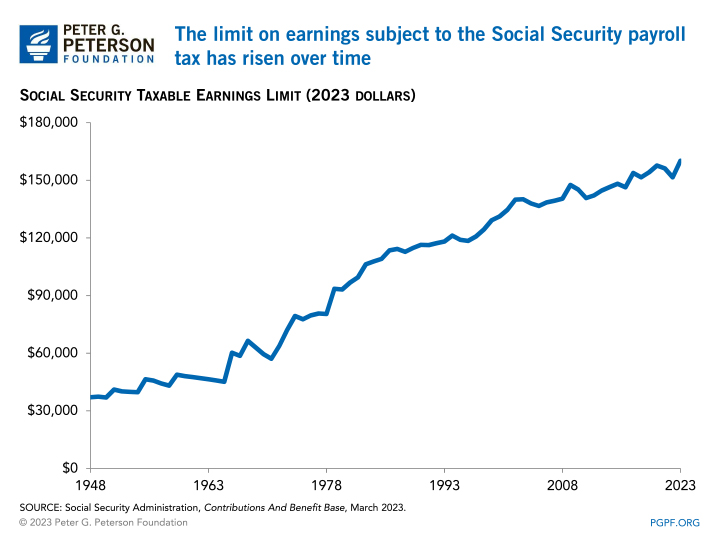

2023 FICA Tax Limits and Rates (How it Affects You)

de

por adulto (o preço varia de acordo com o tamanho do grupo)