How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Descrição

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

Use an S corporation to mitigate federal employment tax bills - Mize CPAs Inc.

Cut Your Self-employment Tax With An S Corporation

Current developments in S corporations

The ultimate guide to self-employed tax deductions

How an S Corp Filing Benefits Small Businesses - Mycorporation

What Entrepreneurs Should Know About S-Corps - Pixel Law

Self Employment Tax - FasterCapital

S Corp Tax Benefits: How Business And Its Shareholders Are Taxed

S Corporation vs. LLC: Differences, Benefits

What Is An S Corp?

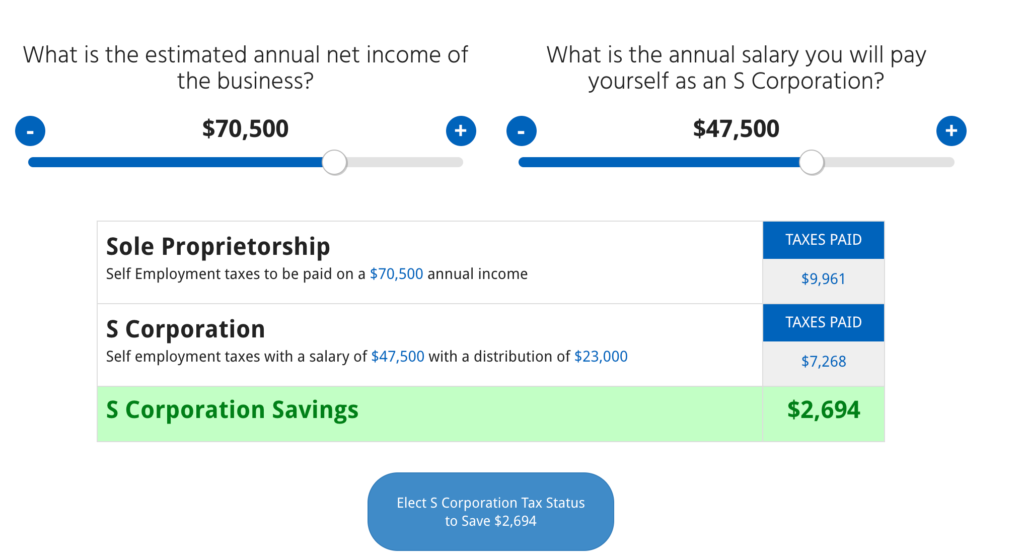

The Right Ratio Between Salary And Distribution To Save On Taxes

S Corp Tax Calculator: Estimate Your Taxes - NumberSquad

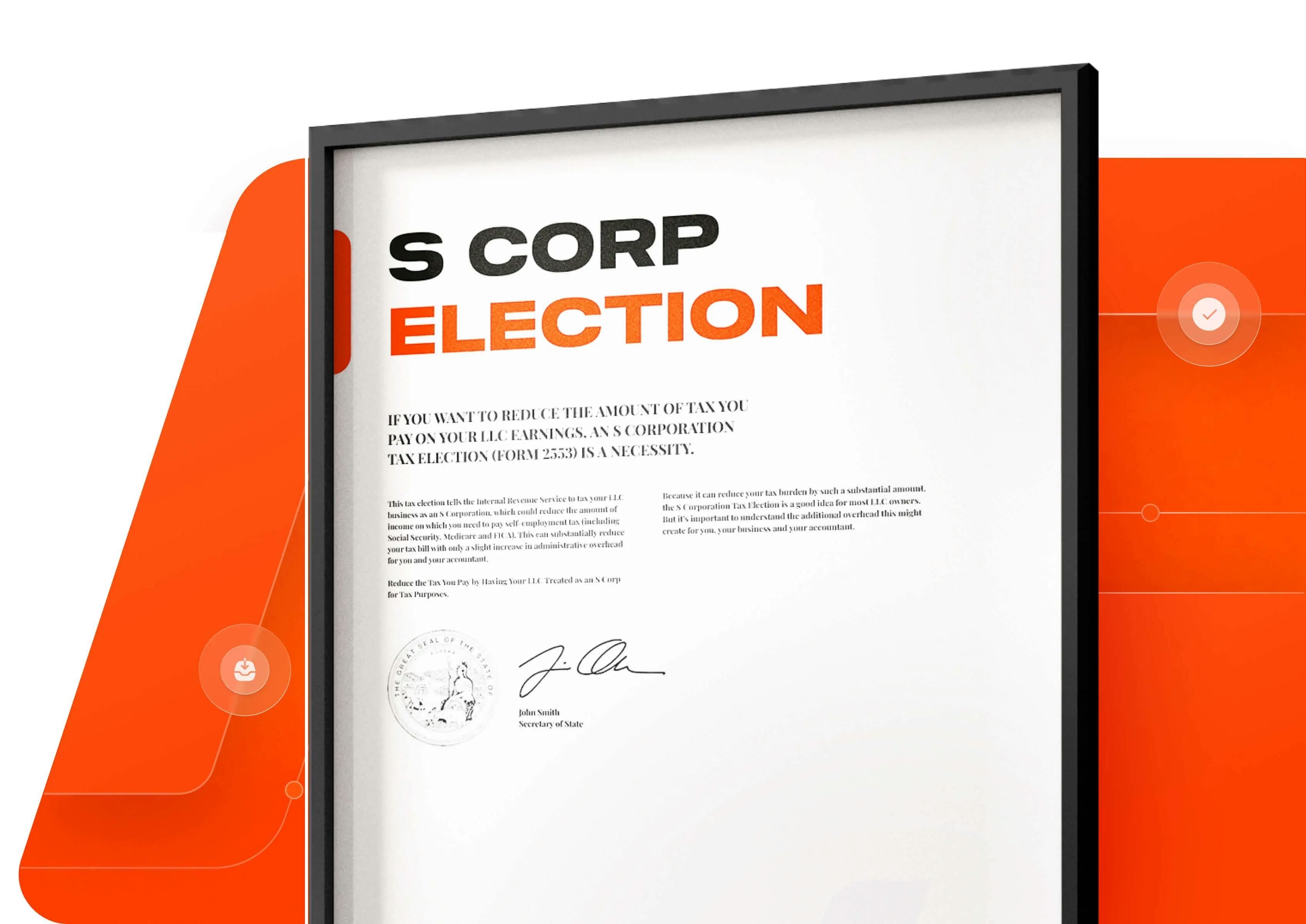

Have Your LLC Taxed as an S Corp - S Corp Election Form 2553

S Corp Tax Savings Calculator

Filing S Corp Taxes 101 — How to File S Corp Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)