FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

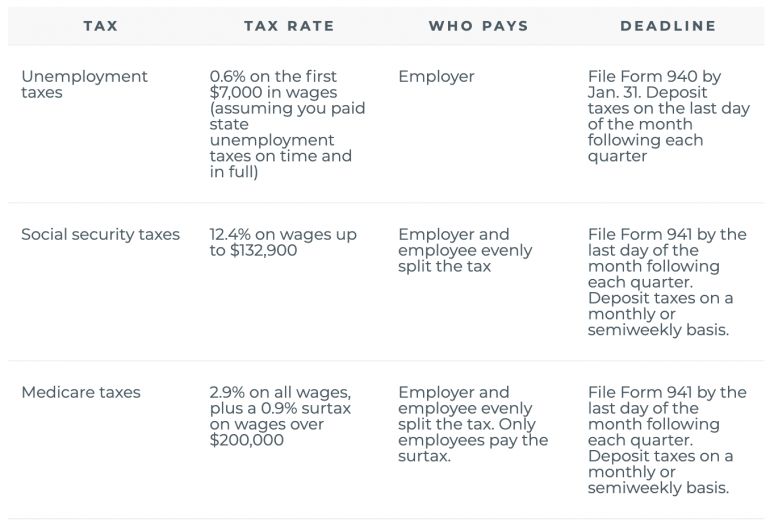

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

What Is FICA Tax: How It Works And Why You Pay

How LLCs Pay Taxes - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Overview of FICA Tax- Medicare & Social Security

Paycheck Taxes - Federal, State & Local Withholding

Document

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

NerdWallet App

Document

How to Ask for a Raise in an Uncertain Economy - NerdWallet

How LLCs Pay Taxes - NerdWallet

2023-2024 Tax Brackets & Federal Income Tax Rates

Smart Money Podcast: Retirement Planning Guide: Estate Planning, Social Security, Long-Term Care and Medicare Explained - NerdWallet

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)