What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Descrição

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

Not Always Tax-Free: 7 Municipal Bond Tax Traps

Publication 505 (2023), Tax Withholding and Estimated Tax

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

What is a payroll tax?, Payroll tax definition, types, and employer obligations

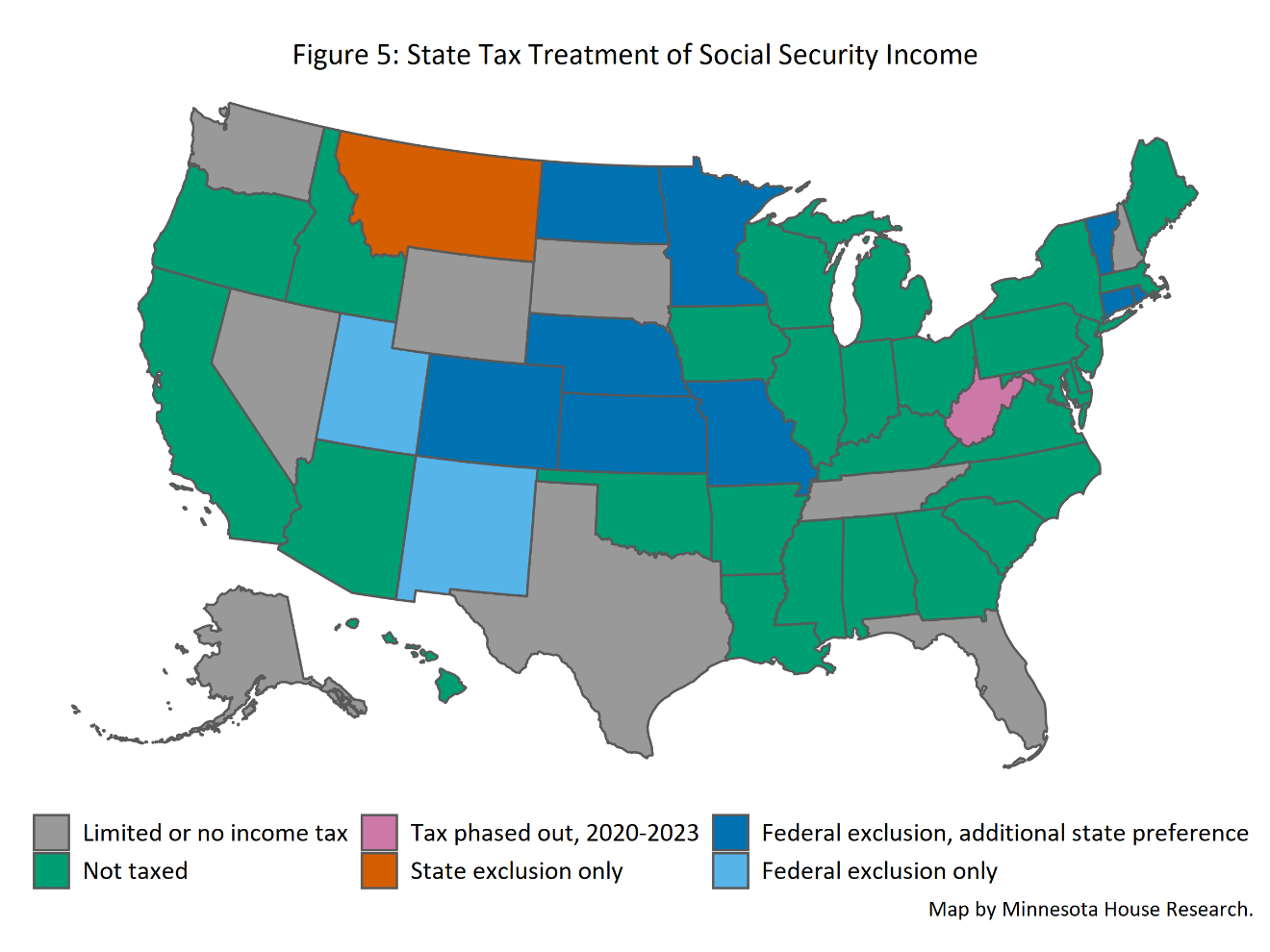

Research: Income Taxes on Social Security Benefits

Taxation of Social Security Benefits - MN House Research

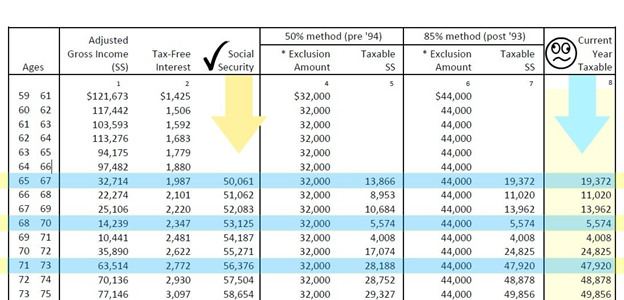

Calculating Taxable Social Security Benefits - Not as Easy as 0%, 50%, 85%

FICA Tax: What It is and How to Calculate It

7 Things to Know About Social Security and Taxes

Types of Taxes – Income, Property, Goods, Services, Federal, State

Payroll tax - Wikipedia

The Evolution of Social Security's Taxable Maximum

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

de

por adulto (o preço varia de acordo com o tamanho do grupo)