MNCs sent tax notices over expat employees' allowances from foreign parent companies

Por um escritor misterioso

Descrição

The demands, ranging from ₹1 crore to ₹150 crore, cover the period between FY18 and FY22 for payments by foreign parent companies to expats working in Indian subsidiaries of MNCs

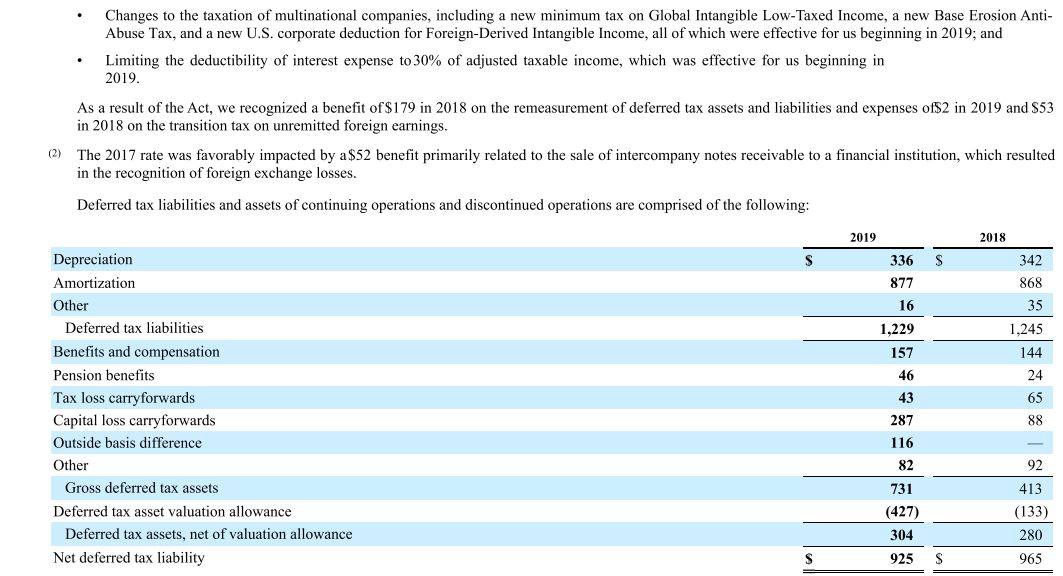

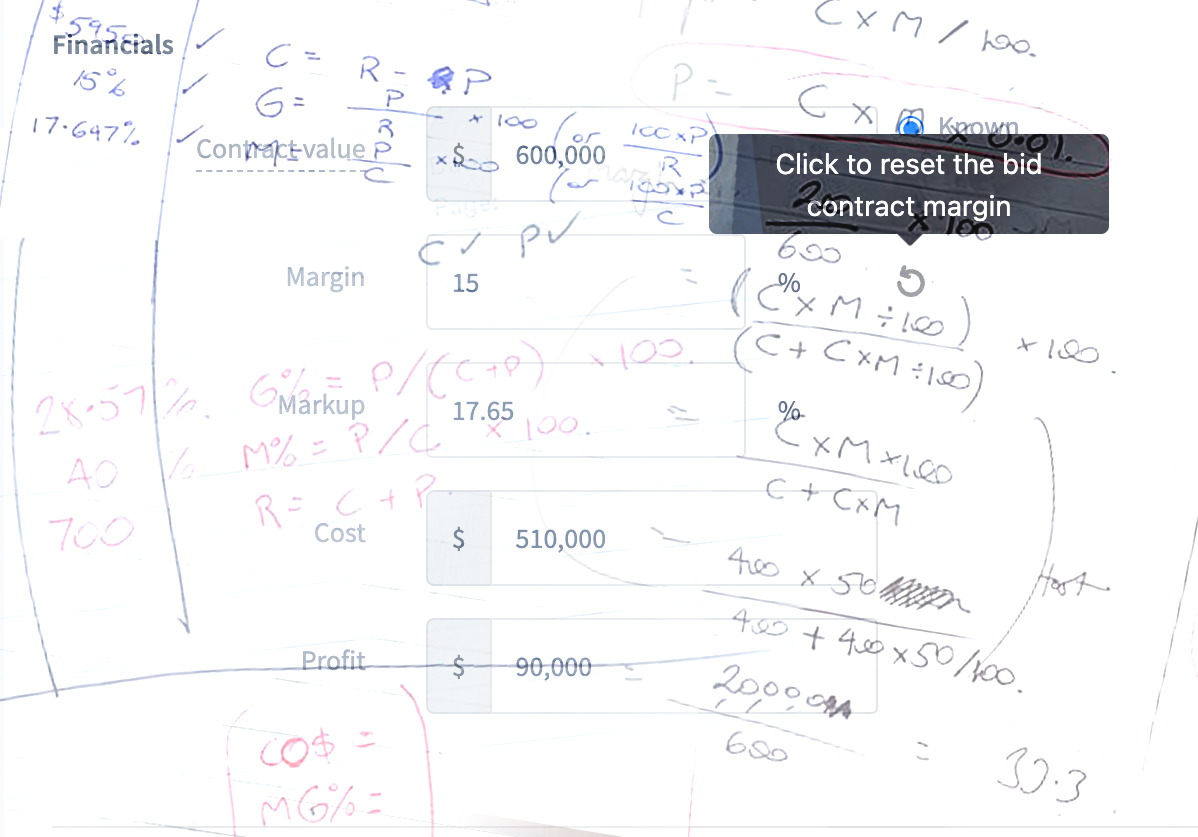

Income Tax: note 12 pg 67- 69 What is the effective

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DY66ULGMPJN3RKE7MFTAOF5374.jpg)

COVID-19's new expatriate employees

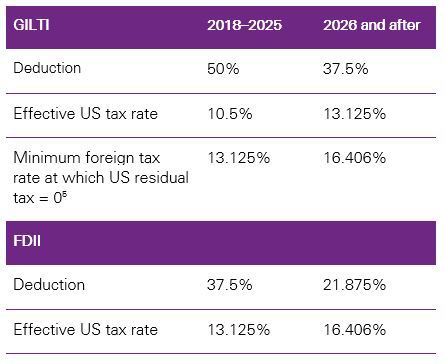

United States - Taxation of cross-border M&A - KPMG Global

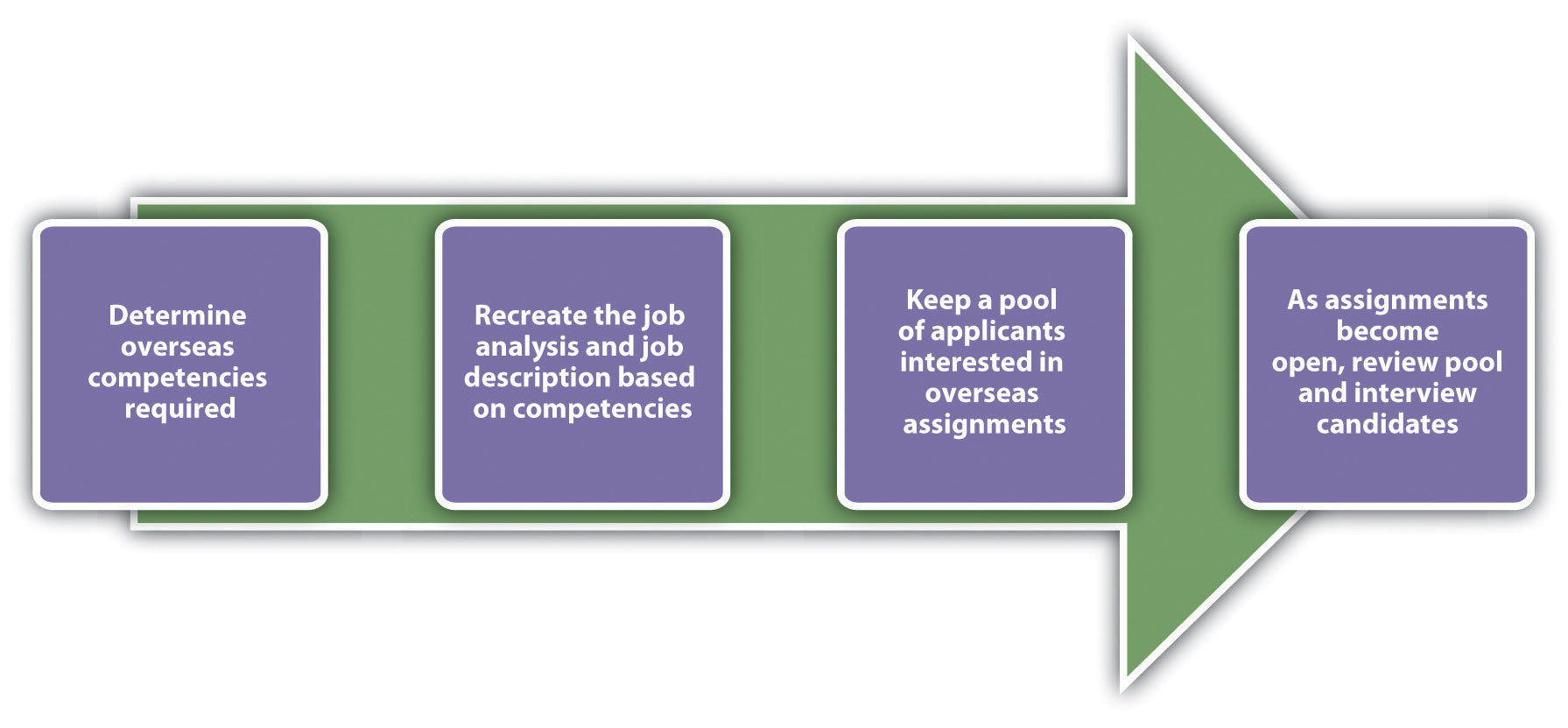

14.3 International HRM Considerations – Human Resource Management

Passthrough-entity treatment of foreign subsidiary income

Expat salaries: Tax notices to MNCs

Bright!Tax

Expatriate - Wikipedia

Tips for Handling International Employee Relocation

9 strong benefits of global mobility for businesses and employees

News

View PDF - Fried Frank

Multinational Companies - 2940 Words

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/cdn.vox-cdn.com/uploads/chorus_image/image/72270159/Zelda_Tears_of_the_Kingdom_beginners_guide_2.0.jpg)