Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Descrição

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

Avoiding Underpayment Penalty: The Consequences of Late Payment - FasterCapital

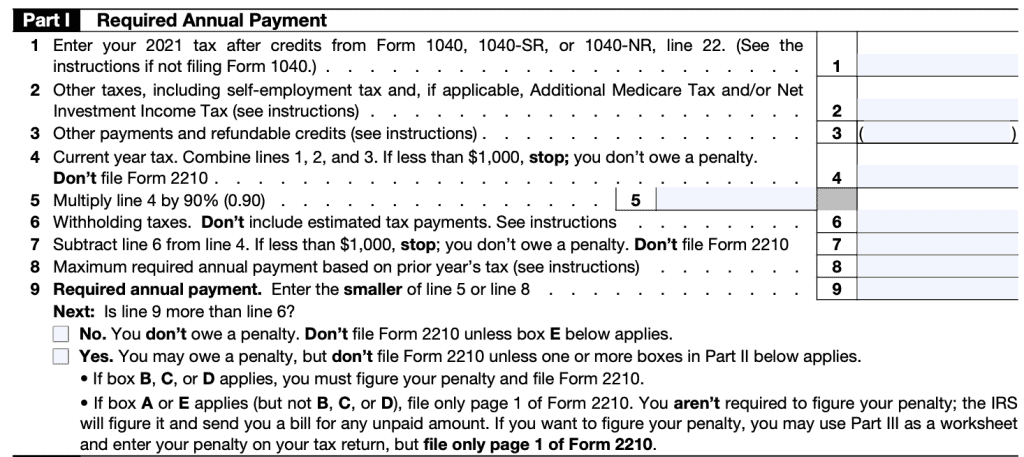

IRS Form 2210 Instructions - Underpayment of Estimated Tax

What Is An Underpayment Penalty? Definition, Examples

What Happens If You Miss a Quarterly Estimated Tax Payment?

IRS Underpayment Penalty of Estimated Taxes & Form 2210 Details

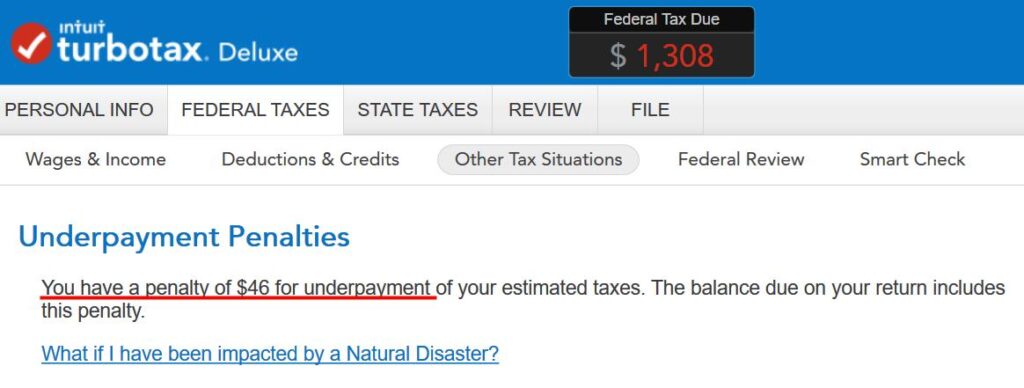

Opt Out of Underpayment Penalty in TurboTax and H&R Block

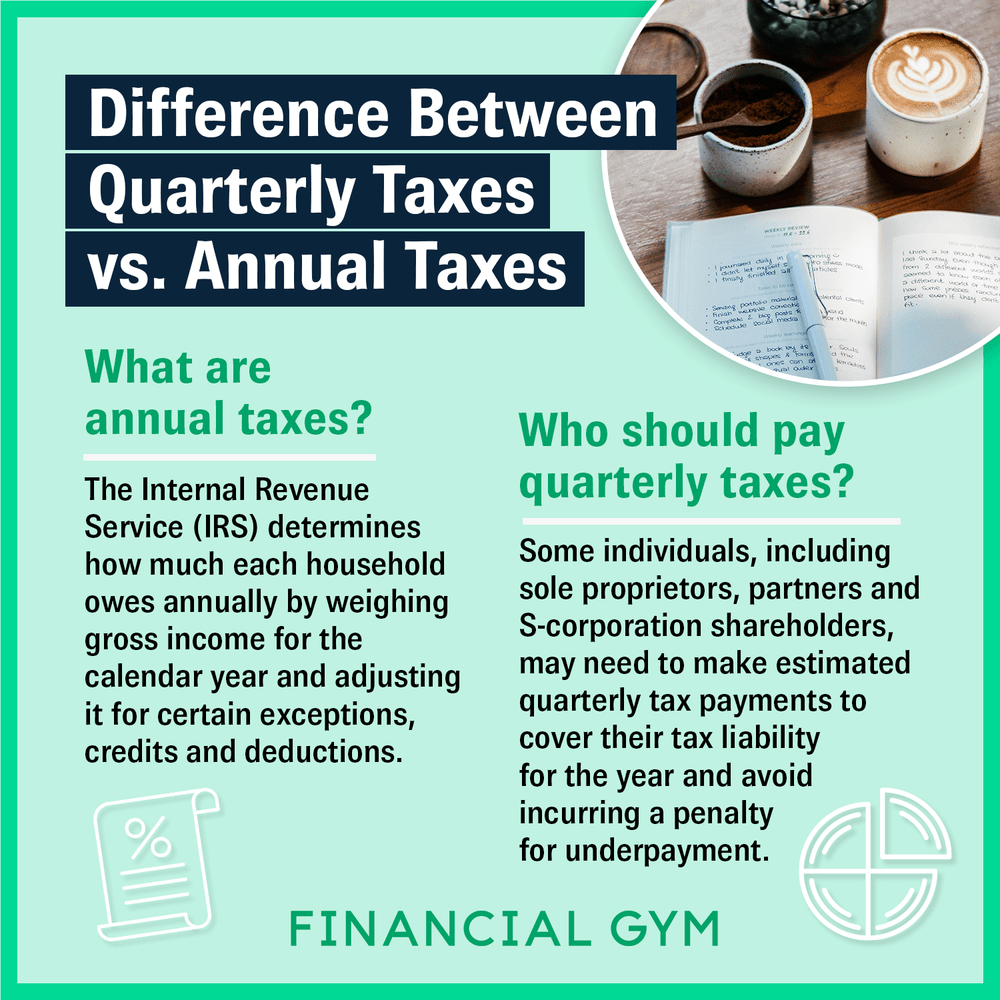

What's the Difference Between Quarterly Taxes vs. Annual Taxes?

Avoiding Underpayment Penalty: The Consequences of Late Payment - FasterCapital

What Happens If You Miss a Quarterly Estimated Tax Payment?

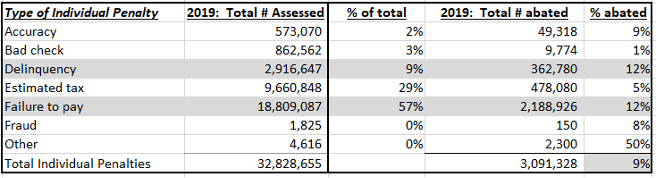

Do's and Don'ts When Requesting IRS Penalty Abatement - Jackson Hewitt

de

por adulto (o preço varia de acordo com o tamanho do grupo)