What are FICA Taxes? Social Security & Medicare Taxes Explained

Por um escritor misterioso

Descrição

Federal taxes for Social Security and Medicare (FICA) are mandatory, so understanding them is important for all HR professionals. Here’s what you need to know.

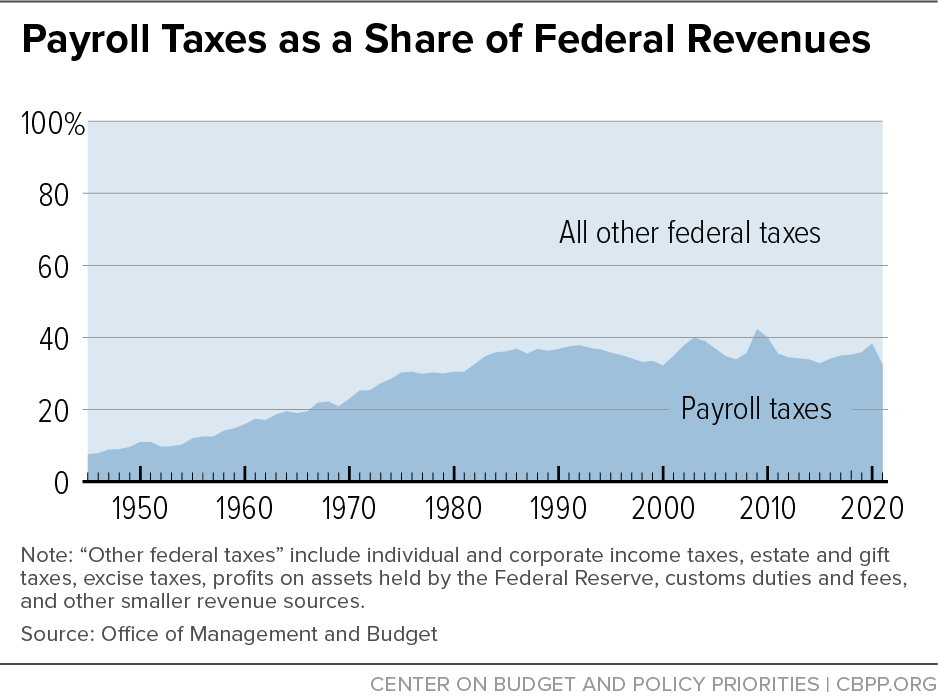

Policy Basics: Federal Payroll Taxes

:max_bytes(150000):strip_icc()/payrolltax.asp_final-f09aa1c3011c44ba925ae501bd4785ad.jpg)

Medicare Tax: What Is It and Who Pays It?

What are FICA Taxes? 2022-2023 Rates and Instructions

Payroll Tax - Definition, Types, Example, How to Calculate?

2021 Wage Cap Rises for Social Security Payroll Taxes

Students on an F1 Visa Don't Have to Pay FICA Taxes —

Research: Income Taxes on Social Security Benefits

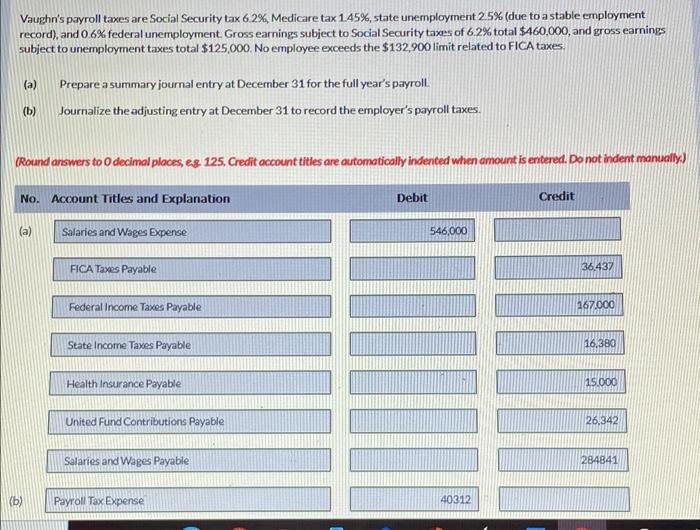

Solved Vaughn's payroll taxes are Social Security tax 6.2

What is FICA Tax? - The TurboTax Blog

Solved Assume that the social security tax rate is 6% and

What are Employer Taxes and Employee Taxes?

What is a payroll tax? Payroll tax definition, types, and

de

por adulto (o preço varia de acordo com o tamanho do grupo)