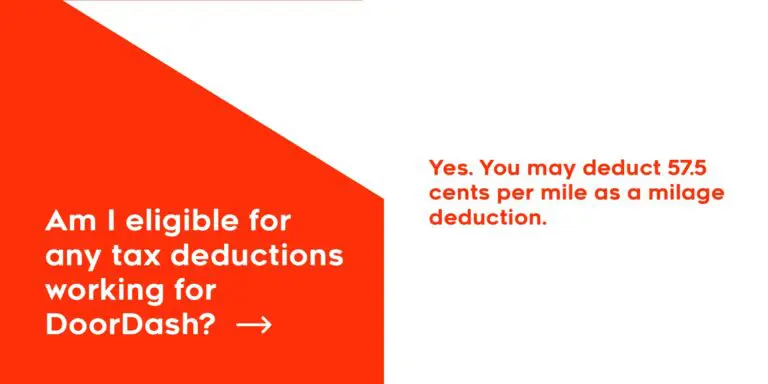

DoorDash Tax Deductions, Maximize Take Home Income

Por um escritor misterioso

Descrição

This article is the ultimate guide for DoorDash tax deductions. Click to read and learn what DoorDashers can write off.

DoorDash Driver Archives < Falcon Expenses Blog

Common Tax Deductions To Plan For in 2022

DoorDash Tax Deductions, Maximize Take Home Income

Delivery Driver Expenses 2024: Does DoorDash Pay For Gas?

DoorDash Software Engineer Salary: Compensation, Benefits, and More

How to File DoorDash Taxes DoorDash Drivers Write-offs

DoorDash Taxes: How Does it Work

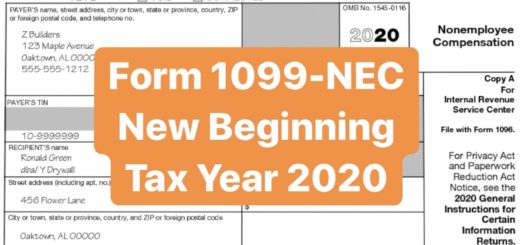

Do 1099 Delivery Drivers Need to Pay Quarterly Taxes? - EntreCourier

How Much Should I Save for Doordash Taxes?

Doordash Is Considered Self-Employment. Here's How to Do Taxes

Track mileage with Everlance

Guide to Doordash 1099 Forms and Dasher Income

de

por adulto (o preço varia de acordo com o tamanho do grupo)