What Is the Modigliani-Miller (M&M) Theorem, and How Is It Used?

Por um escritor misterioso

Descrição

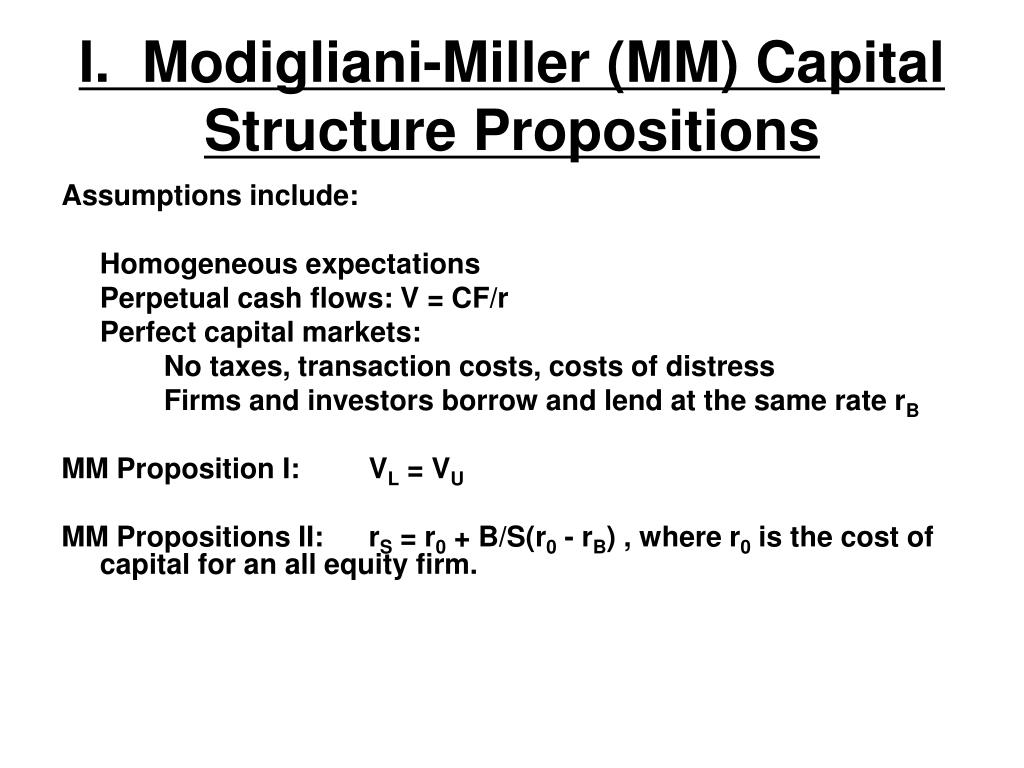

The Modigliani-Miller theorem (M&M) states that the value of a company is based on its future earnings while its capital structure is irrelevant.

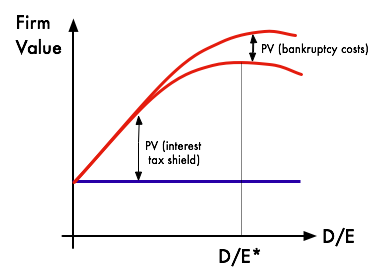

Trade-off theory of capital structure - Wikipedia

finance - Understanding Modigliani & Miller: different graphs in

Chapter 16: Capital structure

Modigliani-Miller Theorem - is it Any Good For Business Valuation?

PPT - I. Modigliani-Miller (MM) Capital Structure Propositions

Modigliani–Miller theorem

:max_bytes(150000):strip_icc()/Optimal-capital-structure_final-e29733f0e93846748c9d8662f1b247bb.png)

What Is the Modigliani-Miller (M&M) Theorem, and How Is It Used?

Modigliani Miller Theorem (M&M) - Meaning, Propositions

Capital Structure Theory (1) - ppt download

Understanding stock market through MM theory

PPT - Modigliani & Miller + WACC PowerPoint Presentation, free

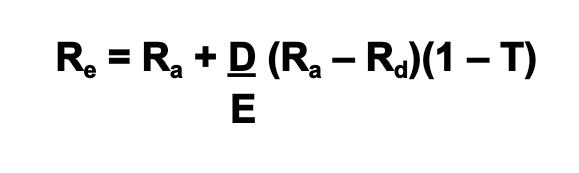

Cost of capital gearing and CAPM, ACCA Qualification

Modigliani-Miller Theorem: Debt Impact on Capital Structure - 2938

de

por adulto (o preço varia de acordo com o tamanho do grupo)