Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Descrição

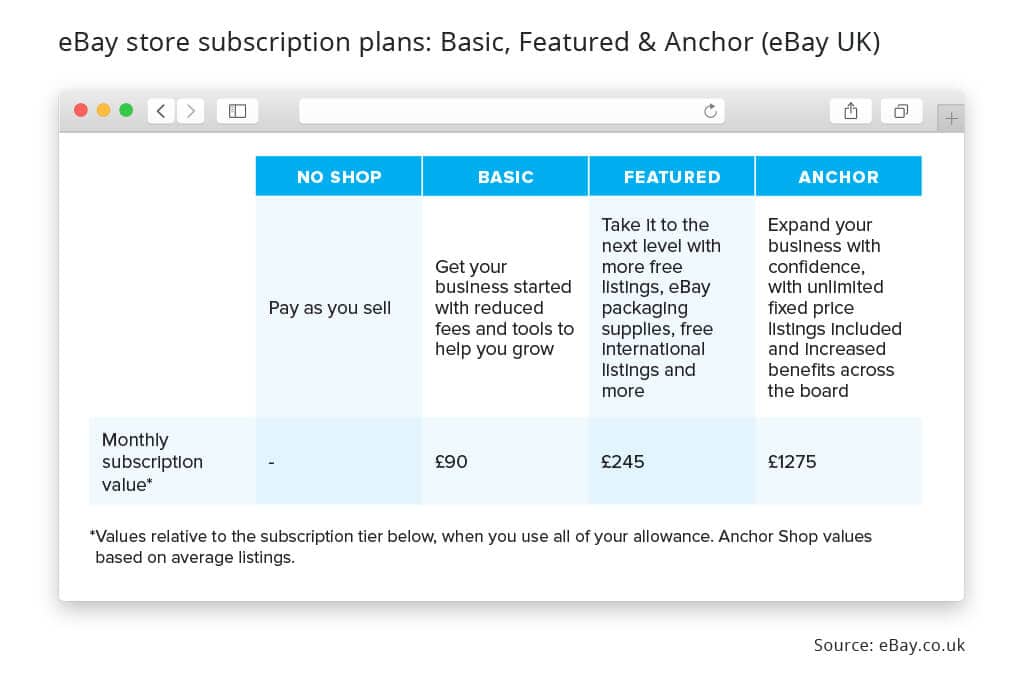

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

Breaking Down The Impact Of UK's Value Added Tax On Sellers

Shopify Help Center Location-based tax settings

Taxes on Selling Stock: What You Pay & How to Pay Less

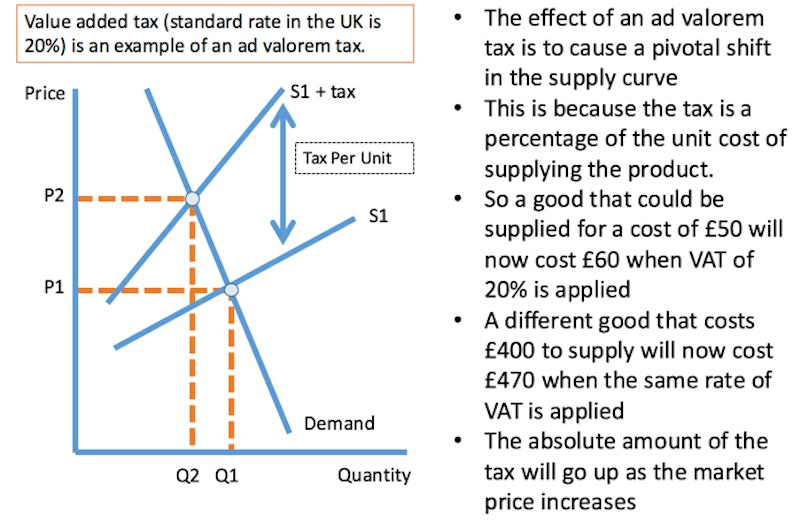

Value-Added Tax (VAT): A Guide for Business Owners

Sales Tax: Definition, How It Works, How To Calculate It

Guide To Planning Your VAT Return by Tax Librarian - Issuu

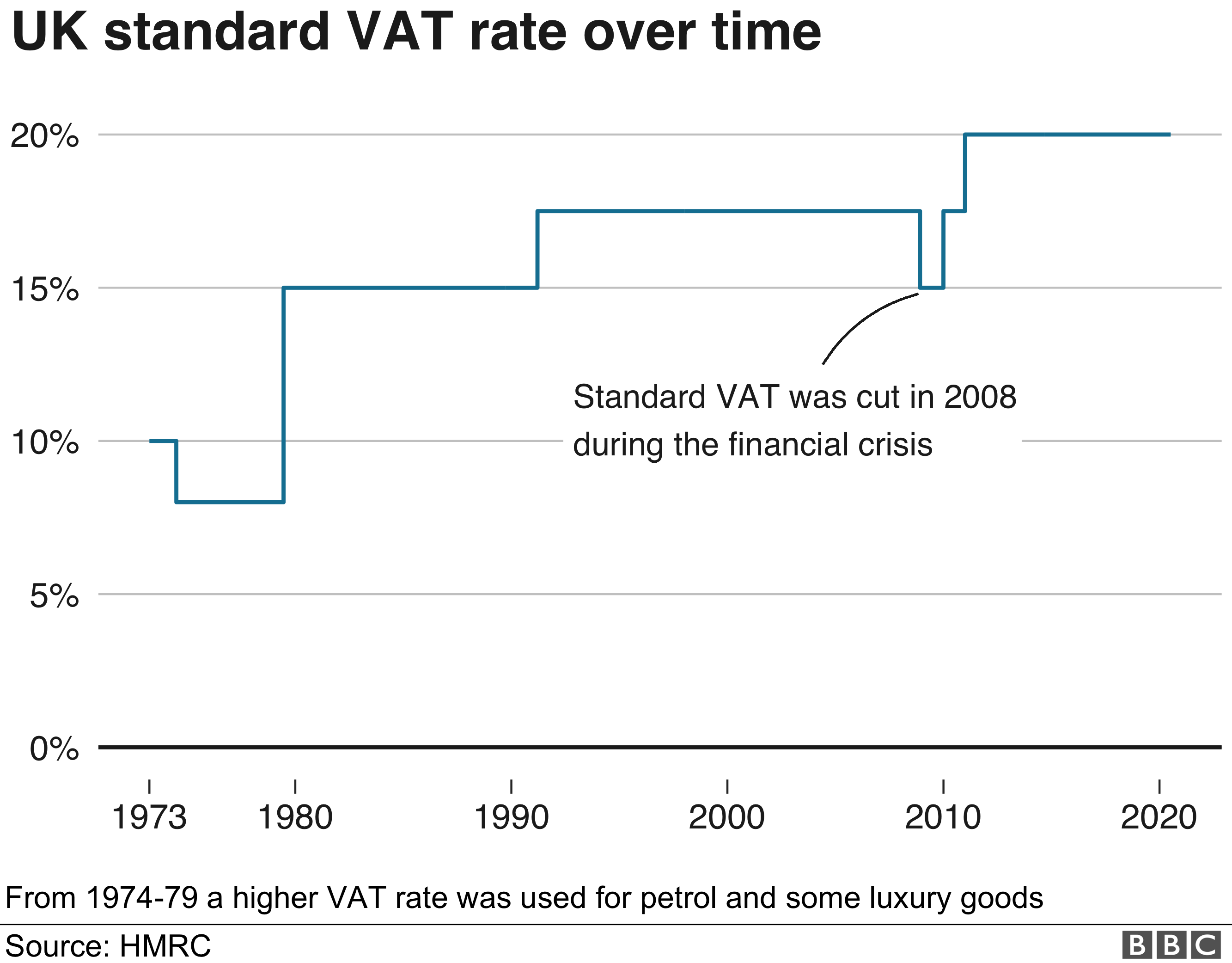

What is VAT and how does it work?

Full article: The Effects of the Value-Added Tax on Revenue and Inequality

Micro and Macro Effects of Higher VAT (Edexcel 25 Mark Question), Economics

:max_bytes(150000):strip_icc()/brexit.asp_final-23d572e0478542dfa7f2493350540677.png)

Brexit Meaning and Impact: The Truth About the U.K. Leaving the EU

VAT on Services Outside UK: Learn the VAT Rules for Services That Take Place Outside the UK

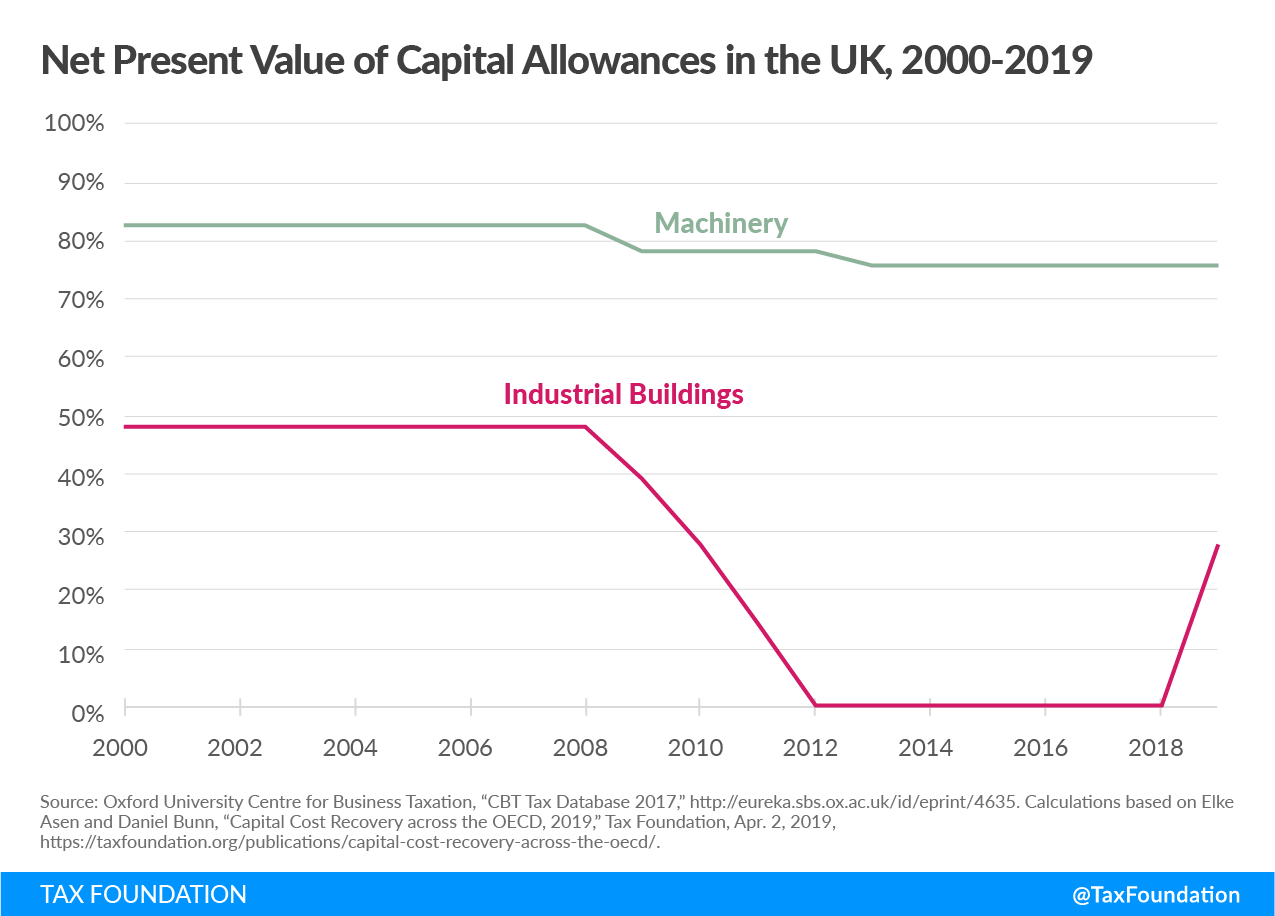

UK Taxes: Potential for Growth, 2019

de

por adulto (o preço varia de acordo com o tamanho do grupo)