How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Por um escritor misterioso

Descrição

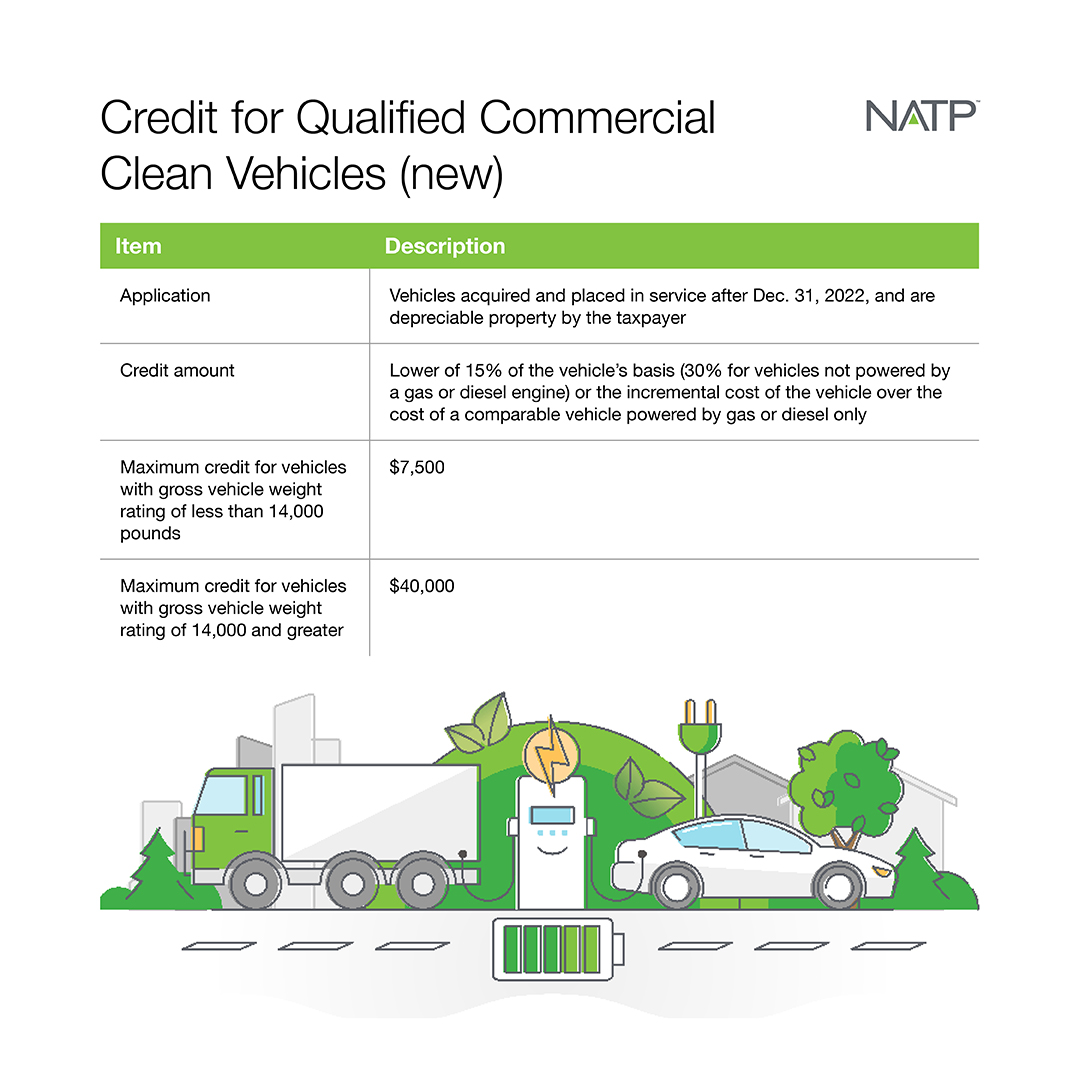

Beginning in 2023, there are two new EV tax credits: the Used Clean Vehicle Credit and the Commercial Clean Vehicle Credit. Here’s what you need to know.

Clean vehicle tax credit: The new industrial policy and its impact

National Association of Tax Professionals Blog

How Do the Used and Commercial Clean Vehicle Tax Credits Work?

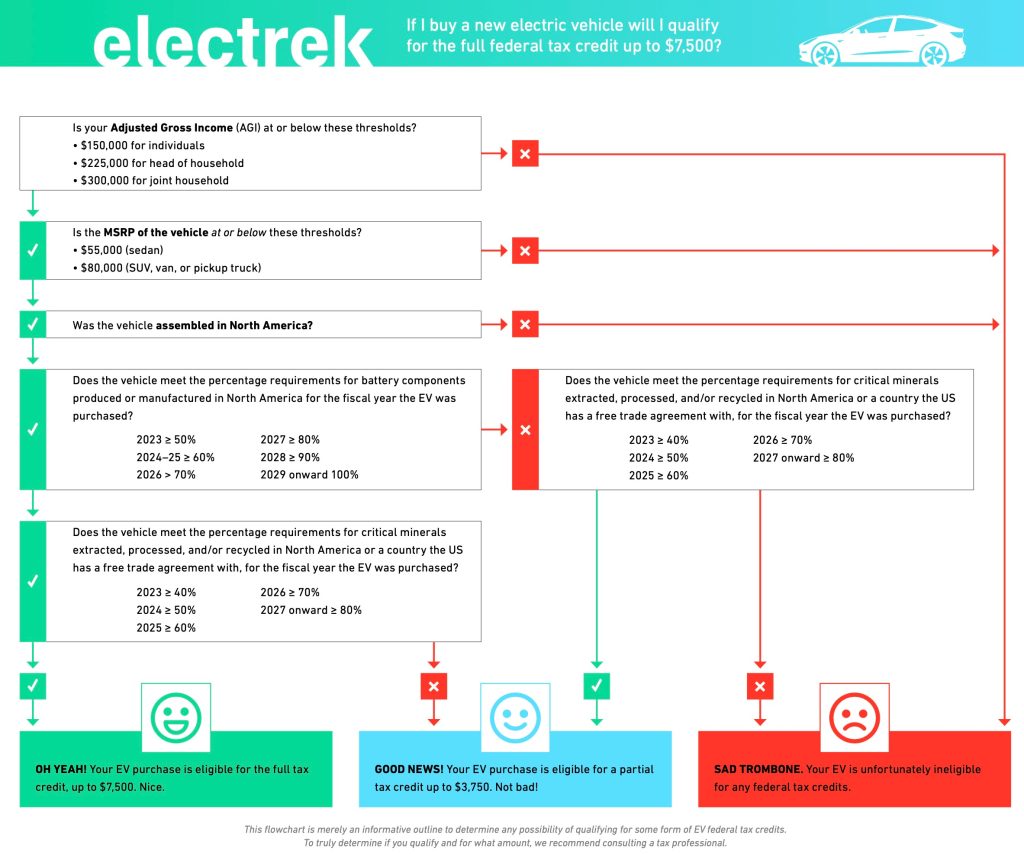

How Do the Electric Vehicle Tax Credits Work?

Upcoming Changes to the EV Tax Credit Explained

EV Tax Credit 2023-2024: How It Works, What Qualifies - NerdWallet

Tax credits: Utilizing Incentives to Improve After Tax Return on Assets - FasterCapital

Here are the cars eligible for the $7,500 EV tax credit in the Inflation Reduction Act in 2023

A comprehensive guide to the 2024 electric vehicle tax credit

$7,500 electric vehicle tax credit may be hard to get. Here are workarounds

Clean vehicle tax credit: The new industrial policy and its impact

Proposed Changes to Federal EV Tax Credit – Part 5: Making the Credit Refundable

What to know about the $7,500 IRS EV tax credit for electric cars in 2023 : NPR

de

por adulto (o preço varia de acordo com o tamanho do grupo)