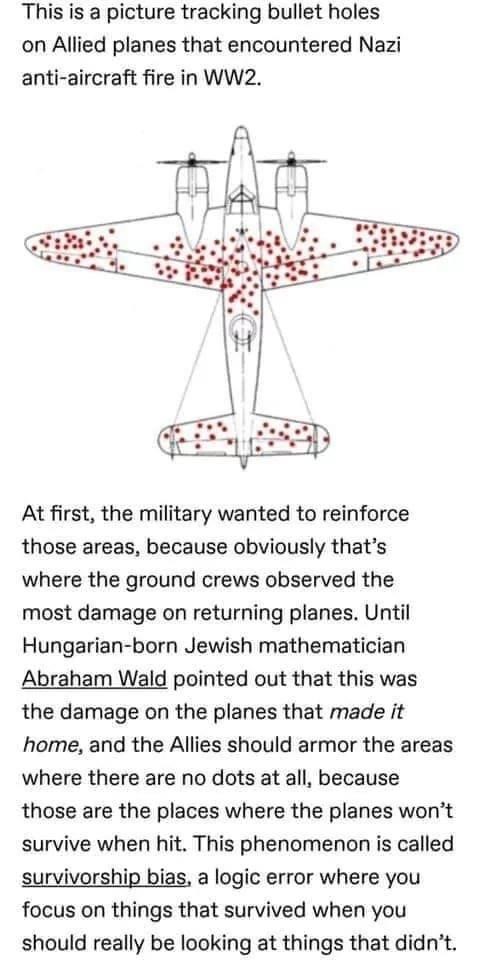

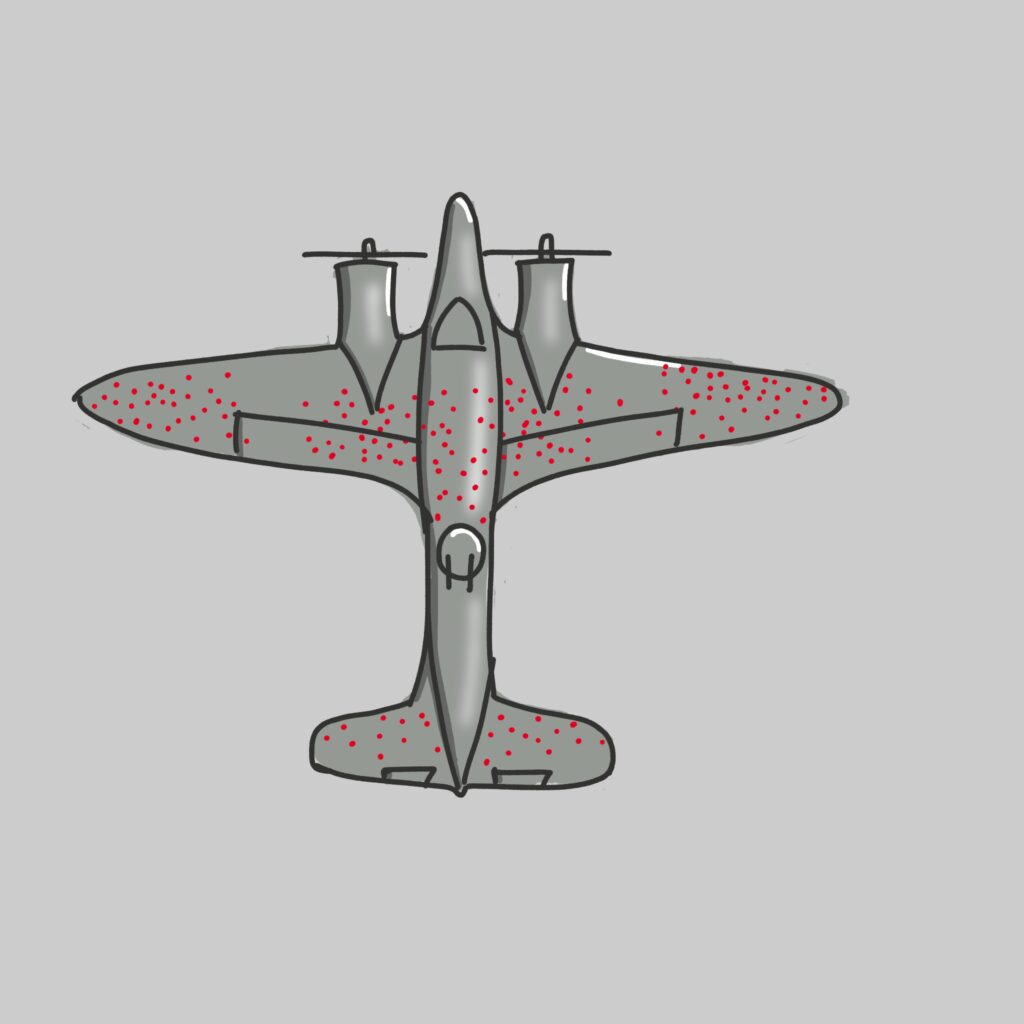

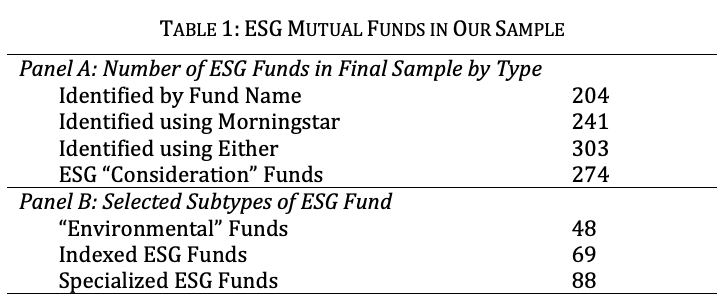

Survivorship bias is one of the clear benefits of ETF investment

Por um escritor misterioso

Descrição

The phenomenon of "survivorship bias" is a clear benefit of investing in ETFs rather than individual stocks

Reverse survivorship bias: Revealing the true nature of investment

Hedge Funds (Indexes) and FOFs - Who Needs Them? - Meb Faber

Equity market investing: Passive and/or active?

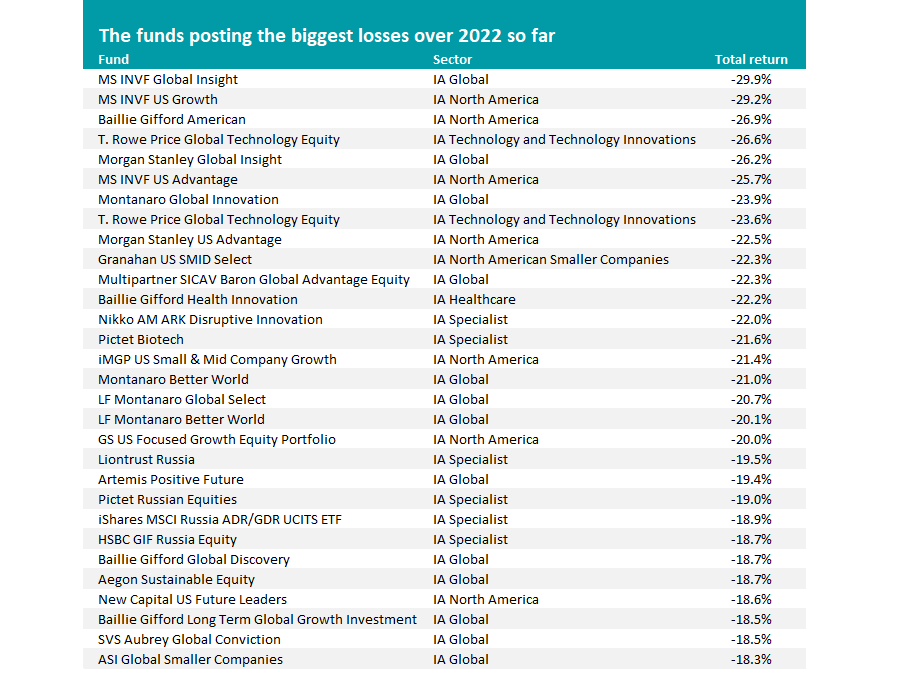

90% of funds lose money over 2022 in worst start of the century

Active Management: The active-passive debate, Special Report

Why Passive Investing Is an Excellent Default Choice – an Active

How Our Strategic Investing Approach Stacks Up Against Passive

How Our Strategic Investing Approach Stacks Up Against Passive

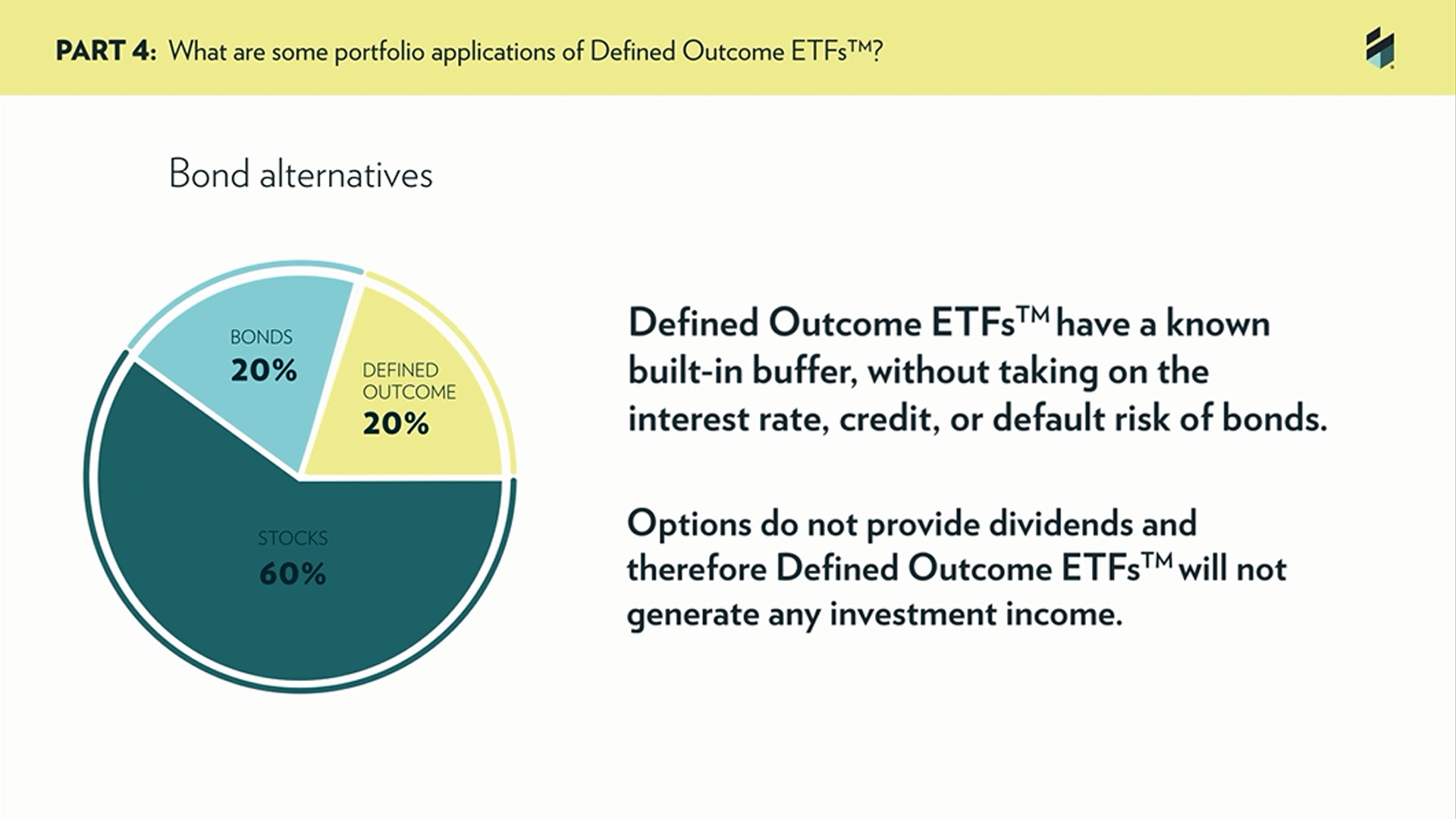

Innovator ETFs: Education

:max_bytes(150000):strip_icc()/equityriskpremium.asp_FINAL-23aad9c0590a4d6688bbb700569ba4a3.png)

What Is Equity Risk Premium, and How Do You Calculate It?

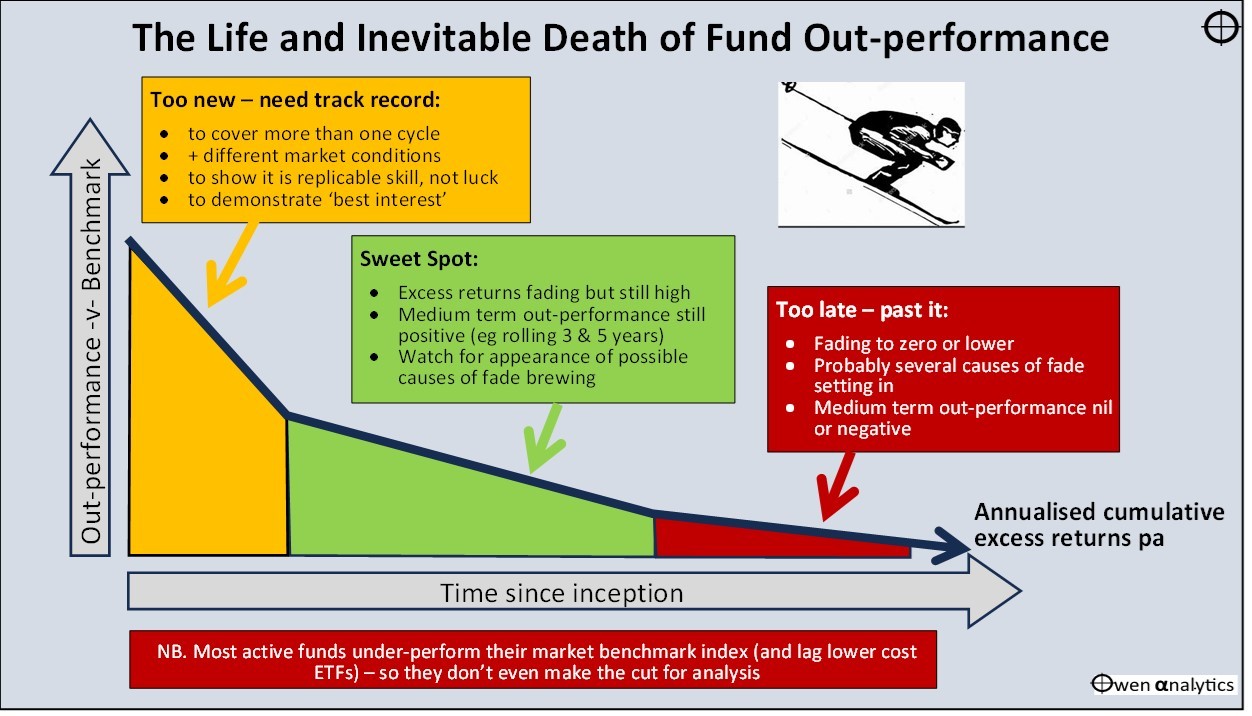

Do ESG Funds Deliver on Their Promises? - Michigan Law Review

Survivorship Bias - Wealth Engineering

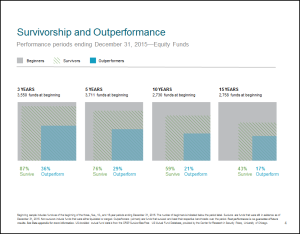

Few active fund managers add value. But even value-adding managers

23 Investing Biases and How To Avoid Them

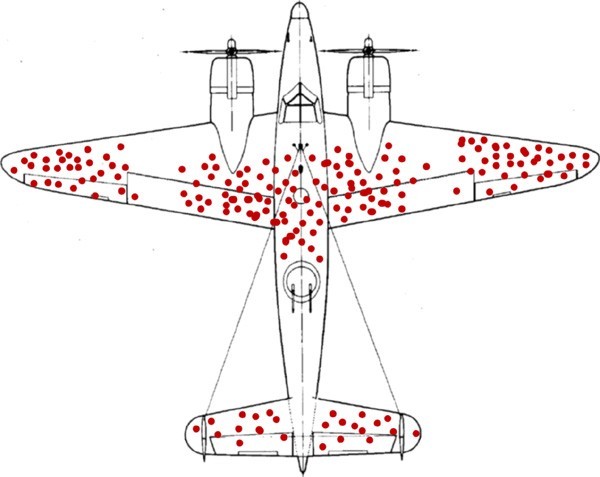

Reverse survivorship bias: Revealing the true nature of investment

de

por adulto (o preço varia de acordo com o tamanho do grupo)